Euro Positioning, US Inflation, And Fee Expectations

A 25 bps reduce from the ECB is extensively anticipated, as a number of committee members have proven assist for this transfer. The European financial system has required a lift since This autumn 2022 on account of stagnant development. A number of quarters of zero or near-zero GDP development and inspiring inflation progress have offered the ECB with room to think about dropping rates of interest for the primary time since 2019. Though Eurozone inflation barely exceeded expectations in April, it’s unlikely to disrupt the progress in direction of the 2% goal.

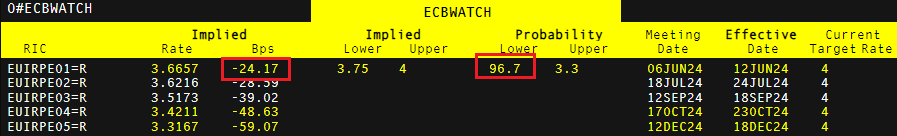

Market expectations point out a 96.7% probability of a 25 foundation level reduce this week when the governing council meets to resolve rates of interest. The important thing focus will probably be on any hints concerning future fee cuts and timings. Prior statements from ECB officers counsel a gradual method to cuts, with indications of a possible maintain in July to evaluate the affect of the primary reduce and evaluate new knowledge. Markets will carefully watch the press convention.

Dedication of Merchants Report (CoT) for Euro Positioning with EUR/USD Value Motion

Latest euro positioning has improved, with a big discount in euro shorts by speculative cash managers, whereas longs are rising. This shift could point out additional upside for the euro as web positioning turns into constructive once more.

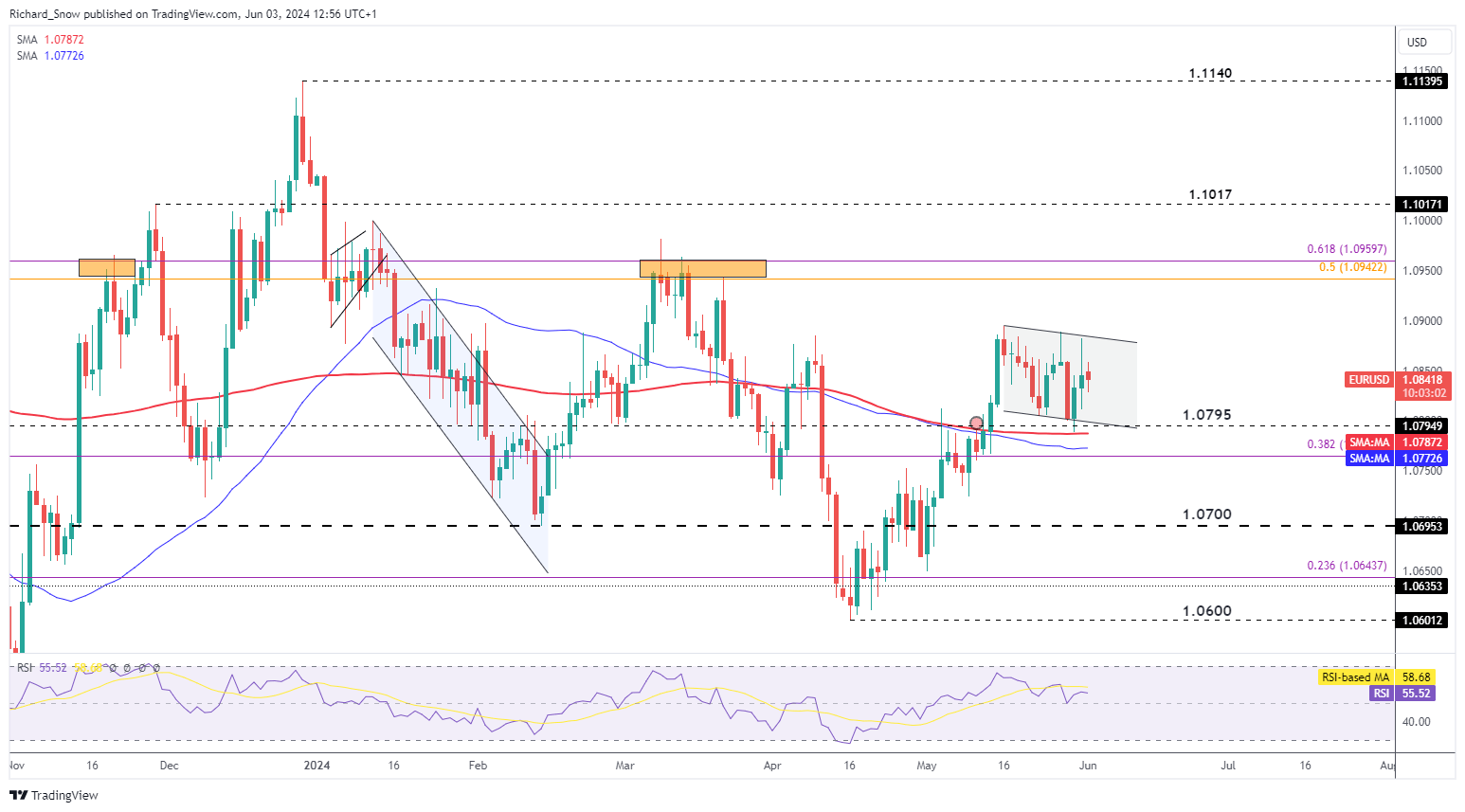

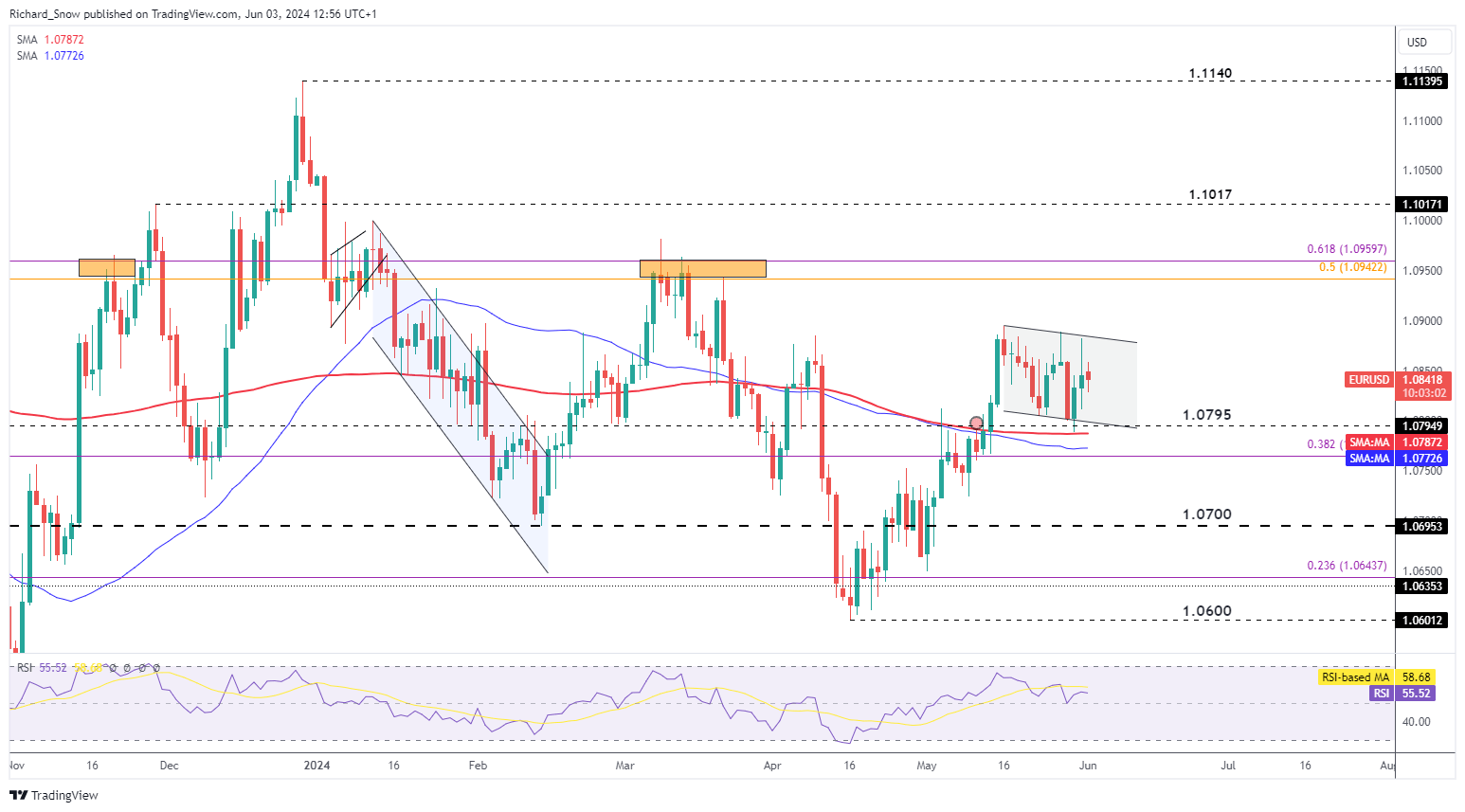

EUR/USD Rises On Weaker Greenback – Extra Upside If U.S Information Weakens

The US financial shock index suggests incoming knowledge is prone to be delicate on account of ongoing restrictive financial situations and the disinflation course of.

Weaker US knowledge has pushed EUR/USD larger, regardless of the anticipated ECB fee reduce. The medium-term outlook exhibits a 2.8% acquire for the reason that April low. Nonetheless, since mid-Could, the pair has moved inside a delicate downward-sloping channel.

Assist is at channel assist and the 200 SMA round 1.0800. Upside ranges are at channel resistance, adopted by 1.0942/1.0950.

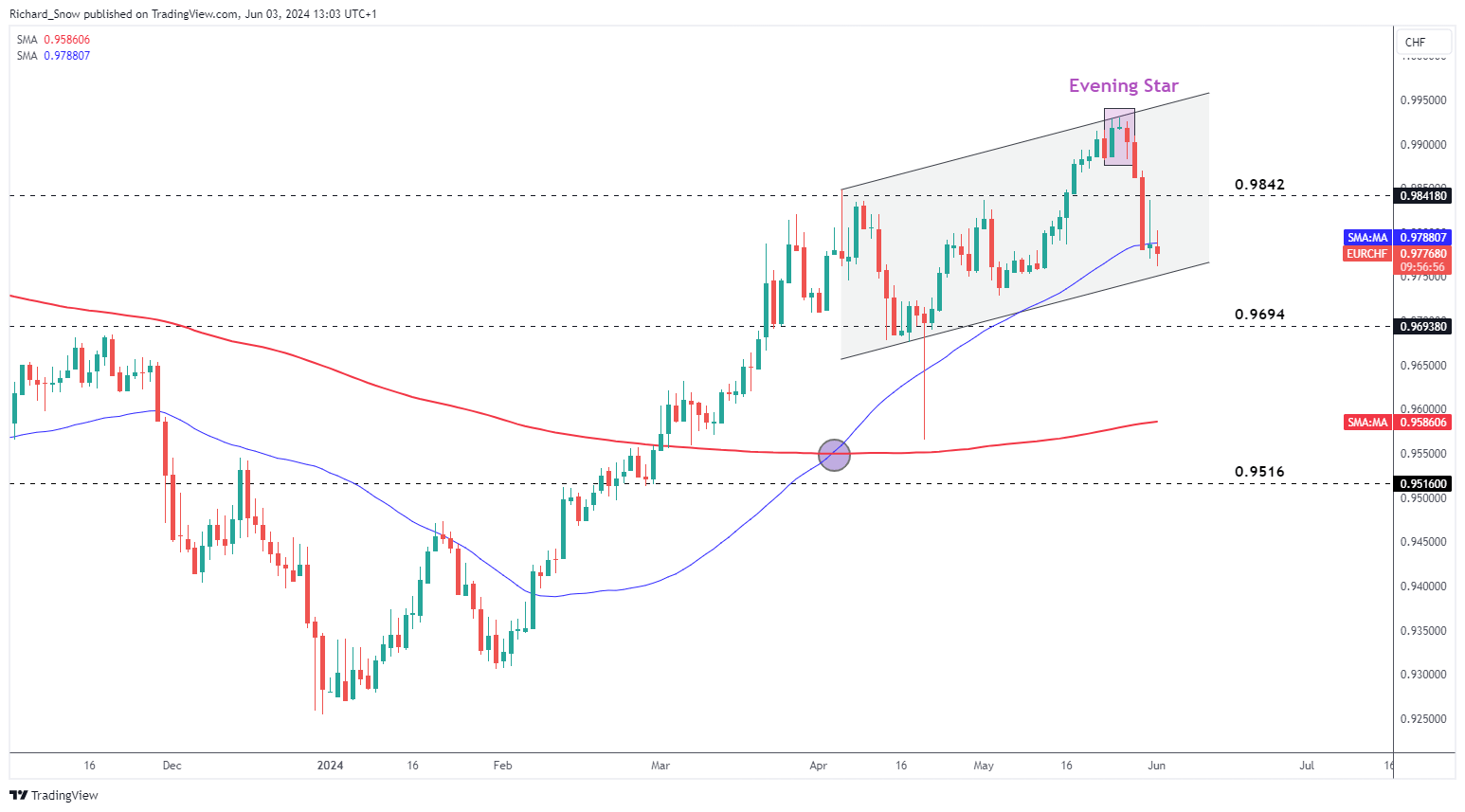

SNB Chairman Jordan’s Inflation Feedback Assist Swiss Franc

Thomas Jordan, the departing Chairman of the Swiss Nationwide Financial institution (SNB), shared his views on inflation dangers, noting potential impacts from a weaker Swiss franc.

His feedback led to the franc recovering misplaced floor, pushing EUR/CHF decrease. The SNB was the primary main central financial institution to chop rates of interest in March, resulting in a broader franc depreciation, which appears to have resulted in late Could with the looks of a night star.

The night star marked a current high in EUR/CHF, showing earlier than Jordan’s feedback. The pair exhibits a draw back bias and just lately broke under the 50-day easy shifting common (SMA), with channel assist as the subsequent key degree. Extra draw back ranges embody 0.9694, adopted by the 200 SMA at 0.9565.

The publish Euro Outlook Earlier than ECB Choice – EUR/USD, EUR/CHF Setups appeared first on Dumb Little Man.

:max_bytes(150000):strip_icc()/ms-hydrangeas-getty-3834c36ba54442e9953d75066abf1b4a.jpg?w=550&resize=550,367&ssl=1)

Leave a Reply